“If You Couldn’t Speak for Yourself Tomorrow,

Would Your Family Know What to Do?”

Most people imagine estate planning as something that matters after they’re gone.

But one of the most important parts of an estate plan isn’t about death at all.

It’s about life.

It’s about the moment when you are here… but unable to make decisions for yourself.

A car accident

A medical emergency

A surgery complication

A sudden illness

A diagnosis that came too soon

We never think that moment will be ours… until someone we love goes through it.

Why Incapacity Planning Matters

If you couldn’t speak for yourself, who would:

Pay the mortgage or rent?

Make medical choices?

Talk to the doctors?

Access the bank account?

Handle bills, business, or childcare?

Decide where you receive care?

Without legal authority, even a spouse or parent can be blocked from:

Bank access

Insurance decisions

Medical updates

Financial responsibilities

Families are often stunned to learn that “being related” doesn’t automatically give permission.

That’s why incapacity planning is love in a legal form.

The Documents That Protect You

A complete incapacity plan includes:

Durable Power of Attorney – someone you trust can manage finances, bills, property, business, and responsibilities

Advance Health Care Directive – someone you choose can speak to doctors, make medical decisions, and follow your wishes

HIPAA Authorization – loved ones can receive medical information

Living Will or Care Wishes – clarity about treatment, comfort, and end-of-life choices

When these documents are in place:

Your family doesn’t have to guess.

They don’t have to fight.

They don’t have to stand in a hallway asking a doctor, “What are we allowed to do?”

They already know… because you loved them enough to plan.

The Personal Side We Don’t Talk About

Imagine your family already carrying the emotional weight of a medical emergency. Now add:

Legal paperwork

Court petitions for conservatorship

Financial confusion

Delayed decisions

Disagreements between relatives

That burden can be avoided with signatures made when you were healthy, clear-minded, and in control.

“If I need help, I’ve already chosen the person who will protect me.”

It’s kindness to yourself and to the people who love you most.

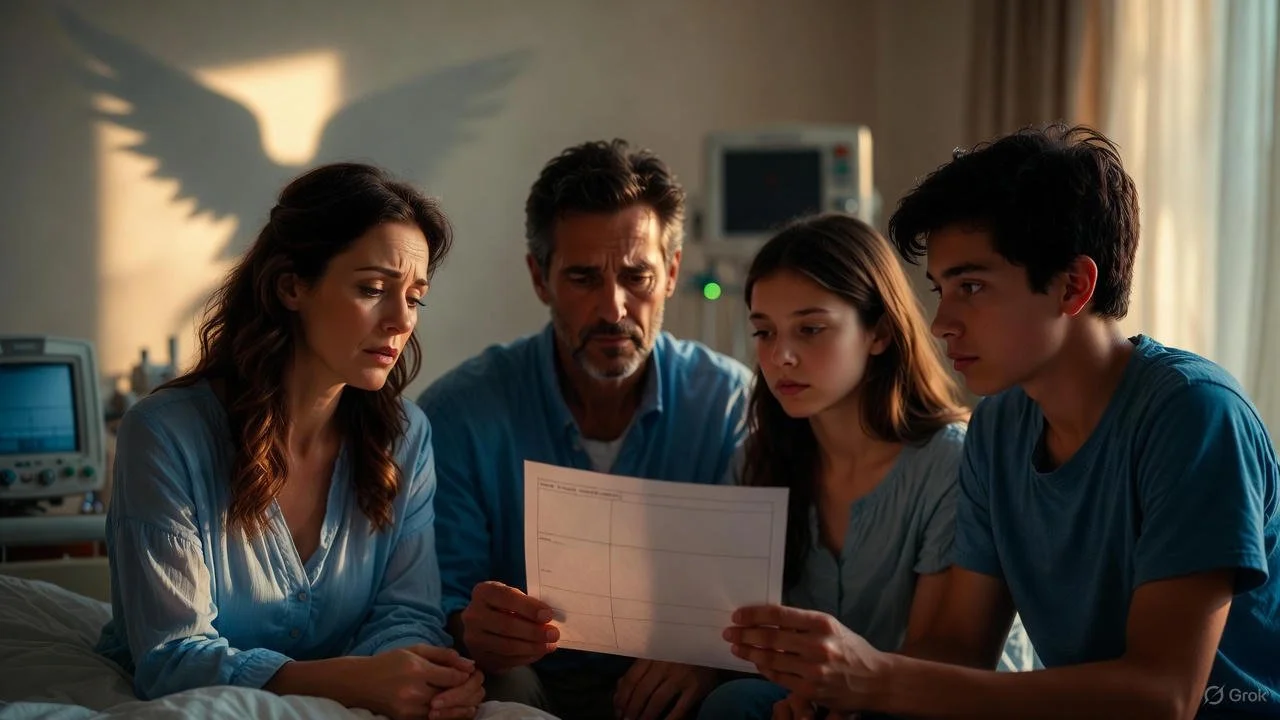

A Story So Many Families Share

When someone becomes incapacitated without a plan, their family can face:

Frozen bank accounts

Months of court involvement

Stressful medical decisions

Uncertainty and guilt

But when someone plans ahead, the story is different:

Bills are paid.

Children are cared for.

Medical decisions follow your values.

And no one has to argue or guess what you would want.

You are still in control—even when life takes control away temporarily.

Planning For the “What-Ifs” Gives Peace Today

You don’t create these documents because you expect something bad to happen.

You create them because you love your people and you want to protect them in every possible moment—

not just at the end of life, but during life’s unexpected chapters.

Incapacity planning is one of the most meaningful gifts you can give:

Clarity

Dignity

Protection

Peace

For you.

For your family.

For the life you’ve worked for.